A Revolving Loan Fund, or a RLF is a gap financing option for small businesses looking to start or expand in Richland County. The fund was a gift from the Richland County Commissioners in 2006, and is administered by Richland Economic Development Corp. The purpose of this fund is to grow and diversify the economy of Richland County when traditional lending alone cannot fund a project.

Revolving Loan Fund Overview

Why Would I need an RLF?

A Revolving Loan Fund, or a RLF is a gap financing option for small businesses looking to start or expand in Richland County. The fund was a gift from the Richland County Commissioners in 2006, and is administered by Richland Economic Development Corp. The purpose of this fund is to grow and diversify the economy of Richland County when traditional lending alone cannot fund a project.

What Projects Are Eligible for RLF?

It all begins with an idea. Maybe you want to launch a business. Maybe you want to turn a hobby into something more. Or maybe you have a creative project to share with the world. Whatever it is, the way you tell your story online can make all the difference.

What Projects Are NOT Eligible for an RLF?

- Businesses that will receive more that 25 percent of their gross sales from gaming

- Use multi-level marketing strategies

- Will house or solicit professional sports teams or events

- Are privately owned recreational facilities

- Are applying for production agriculture loans

- Are money services businesses

How Do I get an RLF?

An RLF loan won’t be the perfect fit for every entrepreneur, however, if it is for you, we are excited to partner with you. Follow these easy steps:

Step 1: Meet with your loan officer and pick up an application or print one off from the application button below.

Step 2: You will meet with REDC staff to assess if your project meets the parameters of the loan.

Step 3: When you are determined eligible for the RLF assistance, your loan officer will be required to provide financial statements and other information necessary to complete the loan application. The purpose of this step is to develop a proposed structure for the deal.

Step 4: The completed loan application packages are then submitted to the RLF committee. The committee may request more information, revise the proposed financing structure, and negotiate with the applicant regarding terms and conditions.

Step 5: The RLF committee makes the decision regarding the possible funding of the proposed project.

Step 6: You, as the applicant, are notified of the RLF committee’s decision.

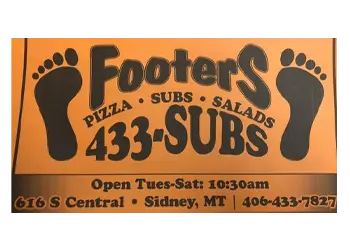

Our Partners who have utilized the RLF fund